georgia ad valorem tax 2021

All state ad valorem taxes on the home and up to 10 acres of land surrounding the home for those 65 years old or older. Total Sales Tax - 7 2021 Inventory Tax Exemptions Freeport Freeport is the general term used for the exemption of ad valorem tax on inventories as defined by Georgia law.

Official Website Of The City Of Lagrange

4000 Exemption for 65 and Older - A 4000.

. You can calculate what the ad. In a county where the millage rate is 25 mills the property tax on that house would be 1000. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in GeorgiaThe basis for ad valorem taxation is the fair market value of the.

Find my nmc pin number. Total Sales Tax - 7 2021 Inventory Tax Exemptions Freeport Freeport is the general term used for the exemption of ad valorem tax on inventories as defined by Georgia. There may be additional fees for listing any lien holders ad valorem taxes and other fees for processing.

The family member who is titling. Mar 26 2021 1033 AM. Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax.

Local state and federal government websites often end in gov. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. There is an 18 title fee and a 20 license plate fee.

For context Georgia charges a 7 Ad Valorem tax on obtaining a Georgia registration and title 7 of the fair market value. The Georgia County Ad. Justia Free Databases of US Laws Codes Statutes.

Georgia does not charge a state sales tax on. Georgia ad valorem tax calculator 2021. These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years.

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. This one-time tax known as TAVT will cover the sales tax on down payments the sales tax on monthly lease payments and the annual ad valorem property tax that drivers were forced to. Best razor for shaving head sensitive skin.

ADMIN 2022-01 - Annual Notice of Interest Rate. This calculator can estimate the tax due when you buy a vehicle. Individuals 65 years or older may claim an exemption from all state ad valorem.

The option to pay the full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Workplace Enterprise Fintech China Policy Newsletters Braintrust case 1845 special specs Events Careers thor rize 18m review. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens.

This calculator can estimate the tax due when you buy a vehicle. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia. Vehicles purchased on or after March 1 2013. Use Ad Valorem Tax Calculator.

2021 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 10 - Ad Valorem Taxation of.

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

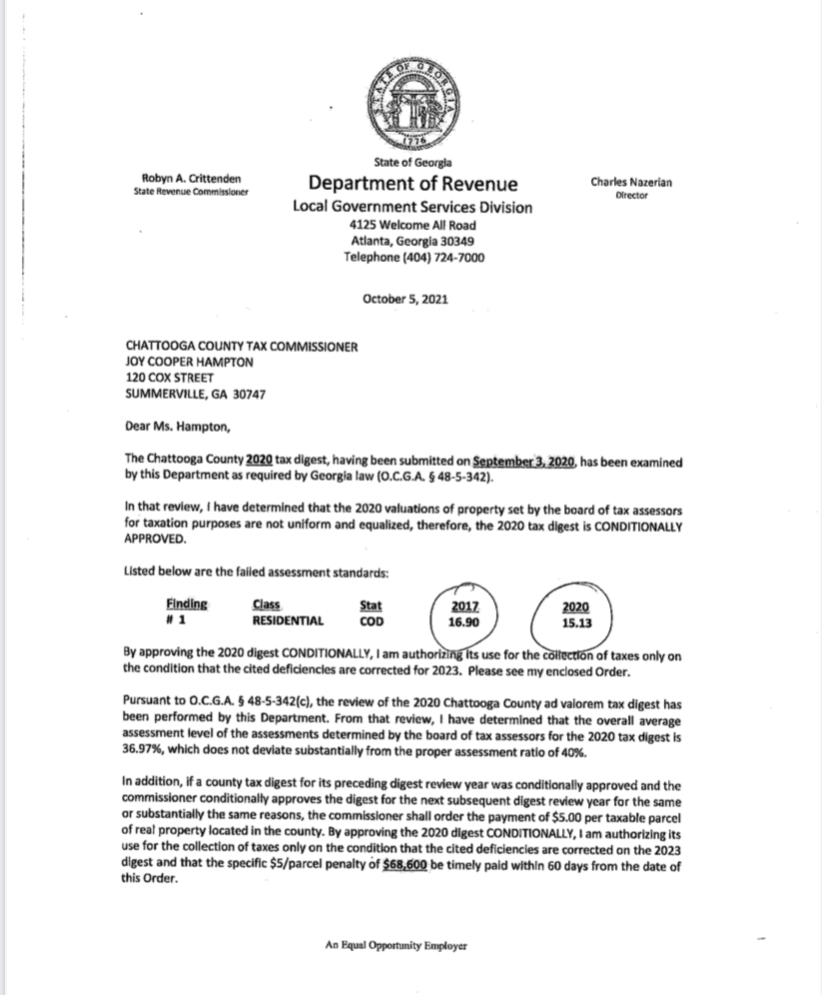

Chattooga County Fined 68 600 Will Appeal Allongeorgia

Sales Taxes In The United States Wikipedia

Georgia Department Of Revenue Local Government Services Motor Vehicle Divisions Ppt Download

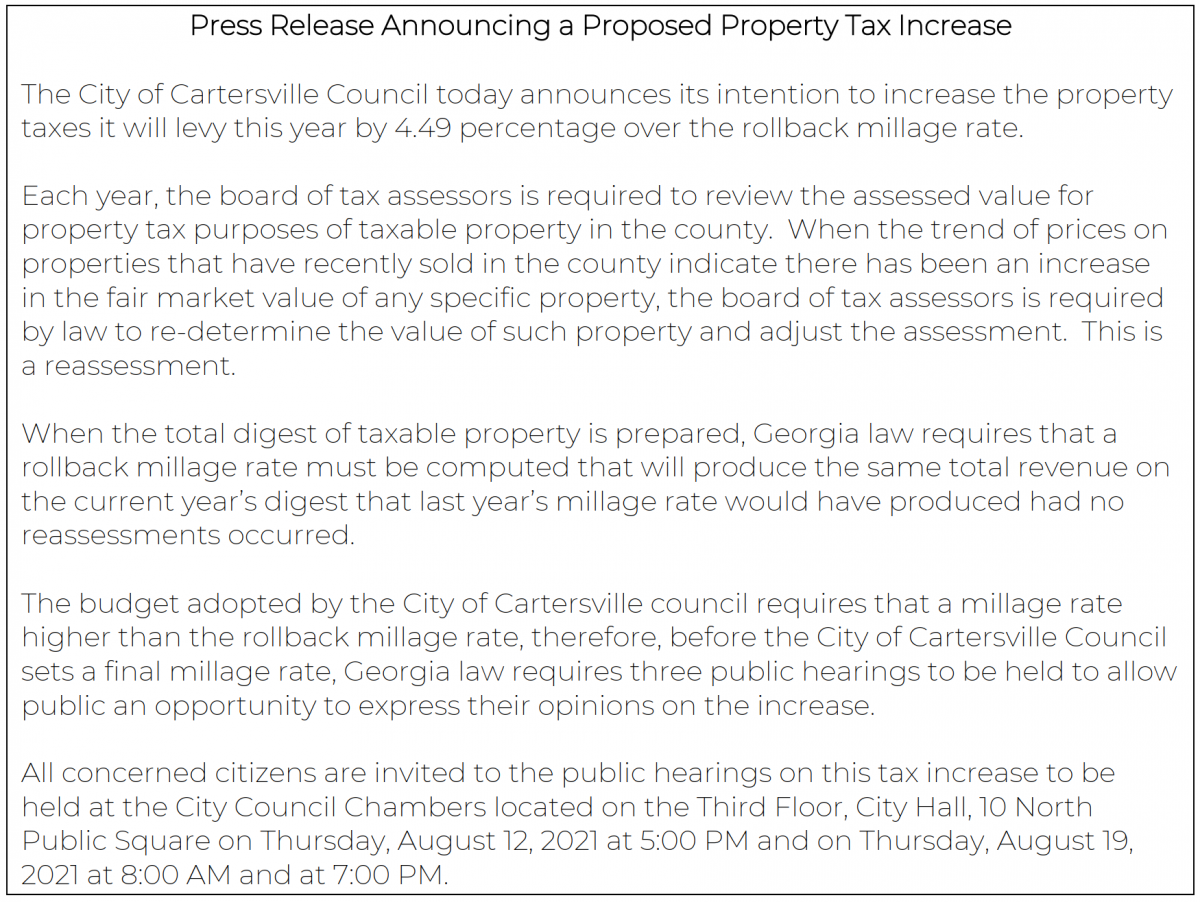

Catoosa County Georgia Residents Suggest Cuts To Avoid Property Tax Increase Chattanooga Times Free Press

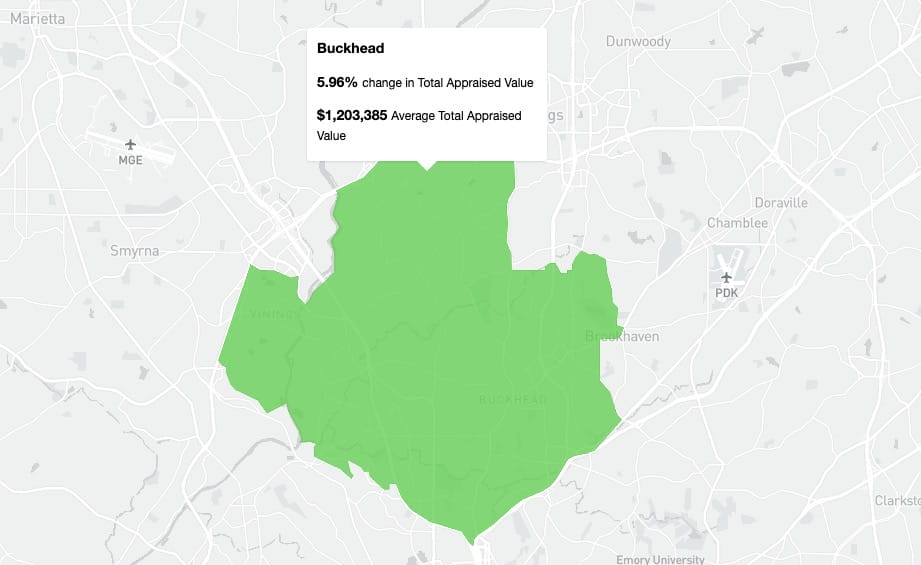

Buckhead Property Taxes 2021 Edition What You Need To Know Buckhead

Georgia Title Ad Valorem Tax Updated Youtube

Sales Taxes In The United States Wikipedia

Brookhaven Seeks Property Tax Savings For Homeowners Reporter Newspapers Atlanta Intown

Property Tax Calculator Smartasset

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube

Are There Any States With No Property Tax In 2022 Free Investor Guide

Barrow County Georgia Tax Rates

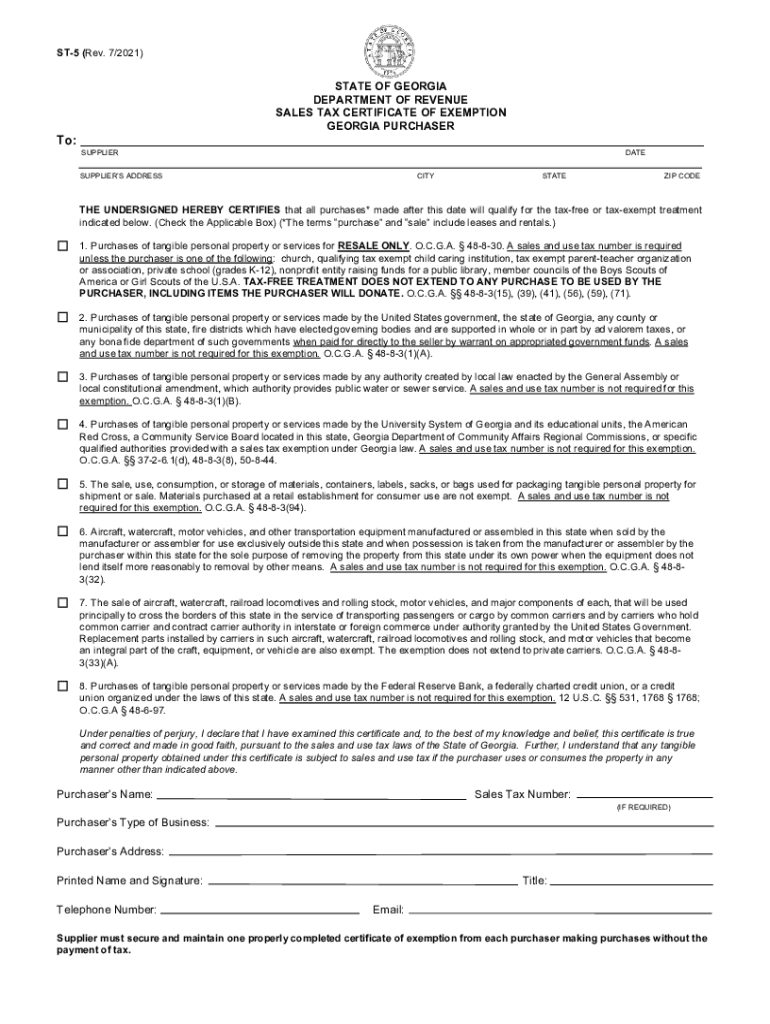

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Property Tax Increases Force Rise In Foreclosure Rates Dsnews